Integrated payments are an essential solution offering numerous benefits that allow hotels to provide a simple, safe and long-term experience to guests. Payment processing is also an important element of the online guest journey. This detailed article should explain how integrated payment processing works in and for hotels with focus on their brand website in order to optimise the booking process (pre-stay) and operational outlets during the guest stay.

Integrated Payments are Accelerating in the Hospitality Industry

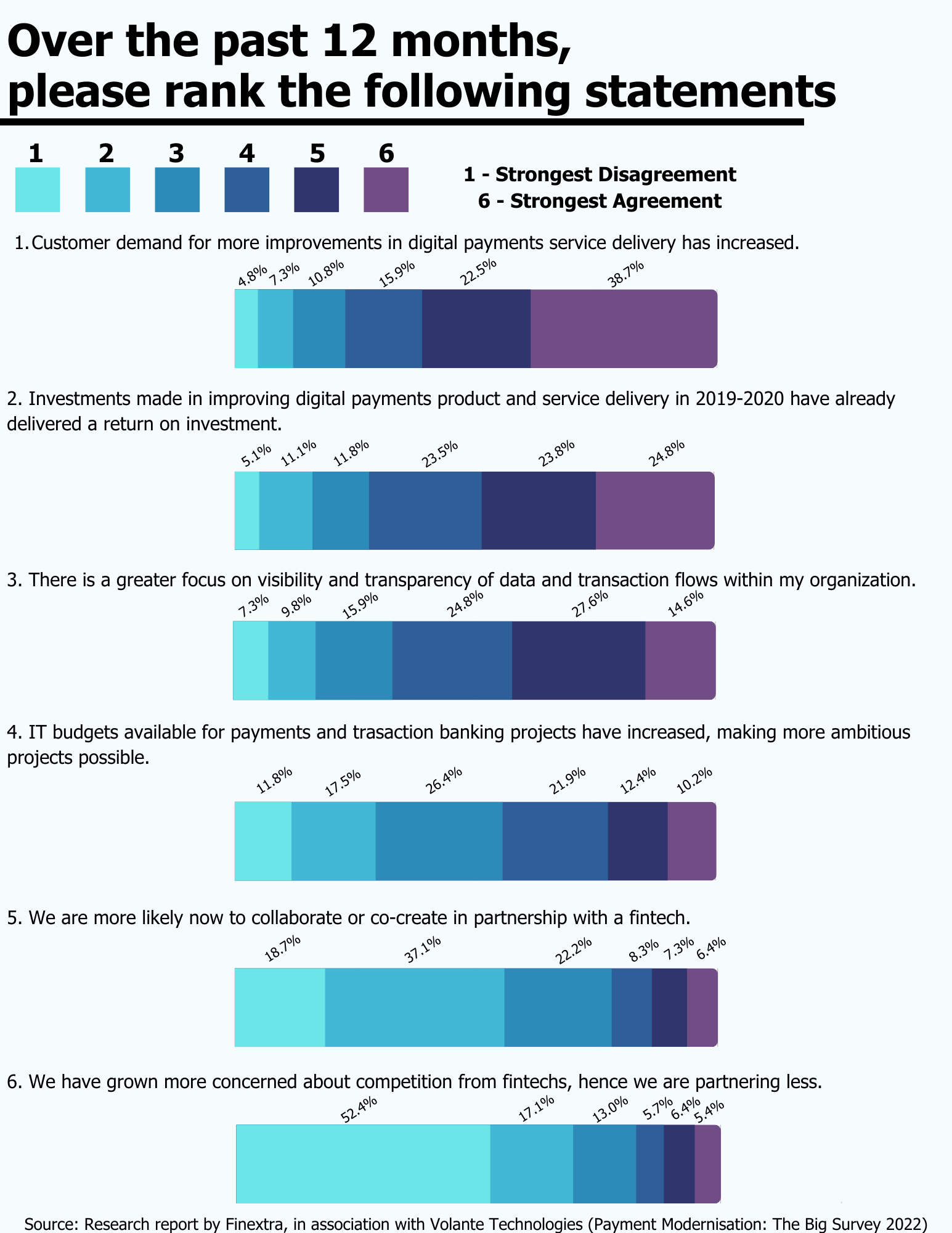

Investments in payments modernisation are accelerating.

There are many reasons for this. From meeting customer demands for price and value-added services, keeping up with competitors, and changes in the regulatory landscape, to emerging opportunities in payment-related areas.

These projects are often part of long-term modernisation and digitalisation strategies; for many organisations, earlier investments are already paying off.

Global providers in the travel industry, like booking.com, HRS.com and D-Edge - just to name a few, have already entered the field.

Anticipating the need for flexible payment options, they combine their offering in partnership with Payment Solutions Providers, avoiding disruptive and risky processes.

The hotel industry is following this trend slowly and in smaller steps.

Investment decisions are made more hesitant (especially since the pandemic), which could lead to a disadvantage and missed opportunities.

With the resurgence of worldwide travel with guest expectations regarding omnichannel and frictionless payments and the demand for more automation in hotels, there is an urgent need to modernise payment flows, options and methods while optimising processes.

Why are integrated payment processes so important today?

- Cashless / Contactless payments

Cashless transaction volume will increase globally by over 80 per cent to 1.9 trillion by 2025 (2020: 1 trillion). Many companies have now switched to card-only payments.

- Cash Abolition

Digital payment systems are rapidly replacing cash worldwide. A cash abolition in the EU is slowly emerging, but the final implementation will still take a few years.

- The advantages are obvious: cashless payments have become ever more secure for consumers in recent years, are fast and uncomplicated, and benefit both banks and the state.

Cash incurs comparatively high administrative, transport, and storage costs, and the shadow economy can hardly be prevented with cash transactions.

Yet payments made from a customer's debit or credit card contain a lot of sensitive data. The importance of securing this data cannot be ignored and is the most important reason to review and modernise the payment process in the hospitality industry.

Legacy payment processes

Although the hospitality industry has undergone many technological revolutions in the last decades (e.g., driven by GDS’, OTA’s, IBE’s, and mobile commerce), many in the industry still rely on outdated payment platforms and manual processes. The hospitality industry has a very complex business model based on a multi-level distribution value chain where each provider in this process has its own cash flows, conditions, and challenges. Due to this complexity, many payment processes were and are often still handled manually in non-scalable operating models.

As an example, many traditional booking engines pass raw payment information to hotels to be manually processed and reconciled.

So, here are just some of the common challenges, pain points, risks and inefficiencies faced by hoteliers utilising legacy payments processes:

- High Operational / Staff effort

- Errors due to manual entries

(entering redundant payment data from the payment terminal to hotel operation systems) - Non-PCI-Compliance (unprotected card/payment data)

- Higher Fraud risk

- Ensuring compliance with local regulations on a global scale

- Accepting digital/online payments

(e.g. for non-room activities, such as in-room dining and meetings) - Accepting local and alternative payment methods

- Duplicative and time-consuming check-in and card authorisation processes

- Negative Customer experience

Integrated Payments make all the difference.

Integrated payment processing systems take all payment information and send it where needed.

Integrations are one of the most valuable commerce solutions for online payments.

Every major payment platform offers integrated payment software, and the number of integrations needed depends on business requirements.

Integrated payments in Hospitality will easily connect payment processing to a hotel's Property Management System and other software to speed up and facilitate the processing of payments and other important services at a hotel, which often also transmits the data to the accounting programs.

This integration is crucial for business operations, as is understanding what an integrated payment system is and how it can benefit hotel-specific requirements.

At a time when mobility is a real challenge for the hospitality industry, properties need to focus on adaptability and using a payment processing system that meets all data requirements.

Hoteliers can streamline their payment operations by connecting the process to dedicated terminals and kiosks, facilitating the management of payments at every stage of the guest journey. This means integrating enterprise booking and operating systems to deliver secure on-site, online, or mobile services across multiple channels.

Some key benefits for hoteliers:

- Efficiency

Automating payment processes and information into the connected systems (fewer errors, higher accuracy). - Speed

Pre-Authorization of payment data reduces waiting time and increases guest satisfaction. - Safety / Security

Customer-validated pre-authorization guarantees a frictionless final payment combined with a PCI confirm/safe data handling.

- Virtualisation

Payments can be taken directly from the software, which sends the confirmation when the payment is accepted.

- Reconciliation

Reconciliation of payment data is automated and saves time.

- Data Insights

Immediate access to real-time payment data supporting strategic decisions and contributing to growth.

The integration of payments is an essential tool that enables properties to offer a safe experience to their guests while providing a real advantage in terms of productivity and safety. It also facilitates the PCI DSS compliance process. The PMS and the payment provider provide part of the compliance.

Payments are creating more customer value.

As in the natural world, the secret to surviving evolutionary pressures is a rapid adaptation, and therefore payment modernisation is necessary.

Internal business decisions and industry trends drive the need to invest in payment integration.

Here are some examples of payment trends:

- Social Commerce

- Digital Payment Increase

- Alternative / Local Payment methods

- Buy now, Pay later (BNPL)

- Real-time Payments

Hotels should be unifying the e-commerce and physical onsite experiences, whereby guests can pre-order services from home or onsite and pay via a terminal or web/mobile/in-app.

Before the pandemic, we were already seeing a change in customer behaviour when it came to paying and using the tech solutions on offer. They now have even higher expectations as mobile ordering and payments have become increasingly common. Customers are even expecting variable payment options and methods they can choose according to their preferences during their interactions with a hotel.

So, hotels should offer a digitalised payment landscape enabling integrated omnichannel payment solutions, as guest satisfaction and increased loyalty are also linked to payment modernisation.

Some other technological developments that hoteliers are implementing:

- Portable Terminals

The integration with Payment Service Providers can give flexibility related to portable payment terminals to process payments, whether at the reception desk or the table.

- Consolidated Arrangements

By operating an integrated payment service, merchants can gain efficiencies by consolidating multiple vendor arrangements. - Customer Self-Services

By offering user wallet technology, hotels/merchants can provide frictionless order and payment services, helping to limit interaction with staff.

The pace of investments in payments modernisation and the pressure from the outside is slowly but surely increasing in the hospitality industry.

Payments as a Service (PaaS)

Integration with software solutions, including those involving payments, could become a real problem.

A historical lack of standardisation has led to massive inefficiencies. A hotel company owning properties in multiple markets must work with multiple payment processors for each market. Sometimes they would use different processors depending on the booking channel (offline, online, direct or through a third-party channel).

A payment solution that is effective and future-proof has to offer both operators and end-users flexibility and a seamless experience.

Nowadays, global Payments Service Providers / Platforms offer a cloud infrastructure combined with API enablement. They continually build on their global coverage, so hotels can focus on hospitality-specific innovation and offload the complexities of money movement, compliance, and payments reconciliation.

Payments as a Service (PaaS) is a cloud-native environment that is offered as a set of custom payment services that can be configured and delivered to end users, significantly reducing the time and cost of implementation. What used to be a time-consuming and costly internally managed process becomes an external service built and maintained by a vendor.

Source: Wikipedia

The Payment Service Provider offering a PaaS solution enables third parties to use domestic, regional, and cross-border payment solutions via a single interface.

With the complexity of regulatory requirements and ever-evolving guest expectations, Payment as a Service (PaaS) is the way forward. Renting what is needed instead of buying it, or building it yourself, will save time and money.

About the Author

Director Solutions Management & Strategy

HRS Hospitality and Retail Systems

Claudia is responsible for the global Payment Strategy within HRS Hospitality and Retail Systems, an IT Company with its own software solutions and Oracle’s largest Hospitality & F&B solutions provider globally (covering 90 countries).

Claudia manages the HRS Payment Platform and related technical products and enhancements, Payment Partnerships, and Payment Integrations. Primary aim is to enable integrated, frictionless, and secure payments for multiple, customer-driven payment scenarios via various payment methods for the respective products.

Before joining HRS at the begin of 2022, Claudia held multiple leadership positions with international software providers in the hospitality environment, primarily in the SaaS segment.

Claudia has a Master's business degree in economics from the University of Applied Sciences & Arts in Dortmund, Germany and over 20 years of experience in the hospitality industry.

Connect with Claudia on LinkedIn

Hospitality and Retail Systems is a Founding Member at techtalk.travel

Also make sure to find these supporting content elements of the editorial Integrated Payments in Hospitality

![V03: The History of Hotel & Travel Technology | [Updated] Infographic](https://www.techtalk.travel/storage/app/uploads/public/63f/e6f/ec8/63fe6fec80447817849943.jpg)

Create an account to access the content.

Get access to Articles, Video's, Podcasts, Think Tanks, Infographics and more.

Click “Sign In” to accept our

Terms of Service Privacy Policy