Direct is not best: It's just a strategy

The Direct Booking Wars. The media, vendors, and industry players have sensationalised the struggle for power in hotel distribution as an “us versus them” battle. You’re either for hotels (and direct bookings) or for intermediaries (and commissions). It’s an emotional issue; no one likes to have their hard-earned revenue siphoned away. Especially by a partner that isn’t doing a good job at explaining its value to your business.

It may be an uncomfortable truth for some, but direct bookings are not a panacea. Hotels are never going to get all of their bookings direct - nor should they pursue that as a Holy Grail.

Let’s break down this emotional issue into its components: distribution costs, consumer preferences, and the value of intermediaries. Then we can see with clarity that the obsession with direct booking is misguided. Rather than anointing one booking channel to reign supreme, we must focus on building long-term relationships with guests - regardless of acquisition channel.

Distribution costs

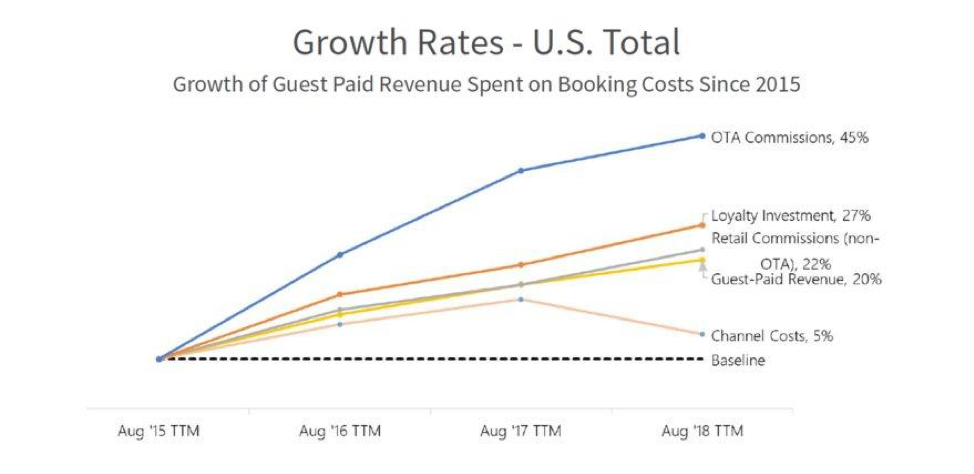

It is true that distribution costs have risen - at least in recent years. Kalibri Labs found that hotels’ net revenue after accounting for distribution costs, such as both OTA and traditional agency commissions, was 83.5% in 2018 - a drop from 84.9% in 2015. Moreover, although rising booking costs extend across most channels, OTA commissions have risen the most aggressively in the past three years.

Caption: Kalibri Labs data from Book Direct 2.0 highlights growth in booking costs.

Hoteliers are indeed keeping less revenue per booking than they used to -- but let's put this in perspective. When the GDS were first introduced, hotels were spending heavily on 24/7 customer service for guests. For example, Choice Hotels launched 24-hour, toll-free central reservations in 1970, when average room rates were $19.28 and minimum wage was $1.28 in the U.S. Reservations weren’t cheap -- and that’s not even including marketing costs!

The gradual shift to self-service internet bookings saved hotels money on physical reservations, as this analysis concluded:

For Hilton, the increased use of the Internet by hotel guests was just one factor that contributed to a 38 percent reduction in costs per reservation from 1992 to 2001.

Even so, that same study determined that the average travel agent commissions from 1995 through 2000 was 2% -- far less than the 10-20% commissions charged by OTAs today. Commissions have also untethered from annual increases in rooms revenue, with spending on commissions by a set of US hotel groups jumping 38% between 2009 and 2012 compared to a 20% gain for total revenue gains in the same period.

All in all, it’s far cheaper to capture and service a hotel booking than it was pre-internet. Given that historical context, do investments in direct bookings, such as customer acquisition through online and offline marketing, as well as technology and labor, really pay off for most hotels? It depends on who you ask.

The guest’s perspective

What’s often missing from these conversations is what the guest wants. It’s nice to consider a hotel’s bottom line, but if the hotel doesn’t provide the booking experience a guest wants, then all the direct booking efforts won’t make a difference.

Guests prefer OTAs primarily for choice. When asked about loyalty, one millennial guest had this to say:

“I don’t necessarily want to visit the same hotel brand every time. I want to experience hotels that aren’t always cookie-cutter. That’s why I like to use apps like Hotel Tonight or Expedia and Airbnb: they show me all kinds of options that fit different moods and trip types.”

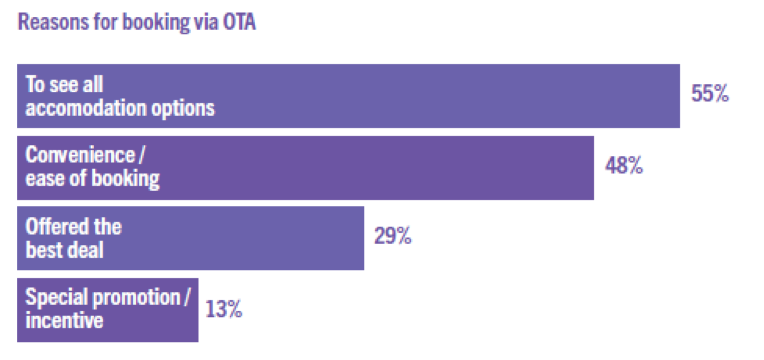

STR research found 55% of consumers booked via OTAs “to see all accommodation options,” while 48% said it was a convenience and the ease of booking.” Hotels can certainly compete on convenience; It's much harder to compete on choice -- especially among younger consumers that are less loyal than previous generations.

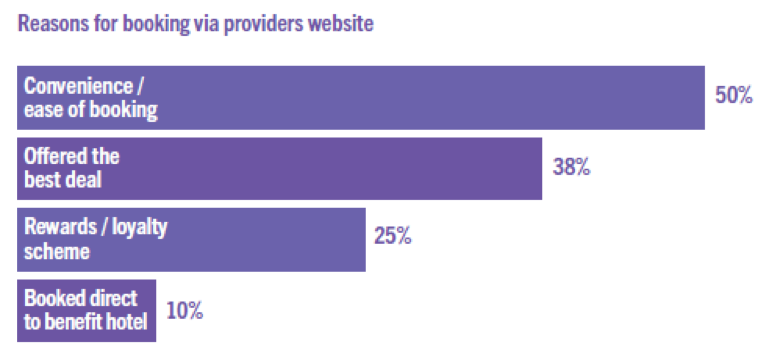

Interestingly, the STR research also suggests that a certain subset of travellers are taking “book direct” messaging to heart: 10% of respondents said they booked directly with a hotel because it “benefits the hotel.” Loyalty, price, and convenience were the other top drivers for travelers booking direct. Consumers have a demonstrated preference for a one-stop-shop. The takeaway is clear: ignore OTAs at your own peril.

Hotels must also remember that OTAs connect hotels to markets that are extremely hard/expensive to access. Case in point: China. EyeForTravel pegged that market’s preference for digital bookings via OTAs at more than 70%.

Hotels that over-index attention towards profitability-per-booking may be short-sighted and miss out on demand from the world’s largest travel market. When it comes to these types of bookings, direct is definitely not best. It would be cost-prohibitive for hotels to capture this demand in the direct channel.

The value of intermediaries

OTAs are masters of two things: user experience and marketing. Expedia invests heavily in both a “test and learn” culture and a massive marketing engine, spending 47.2% of its revenue on selling and marketing per its end-of-year results for 2018. Booking also spends heavily, spending well over a billion dollars per quarter on performance marketing. And that figure is just what it spends with Google!

With such a massive level of spending, the major OTAs can reach guests that most hotels could never reach on their own. The company also has a trove of data around consumer behavior and shopping intent. It's nearly impossible to compete with such a rich source of insights that help Expedia more efficiently convert advertising dollars to bookings.

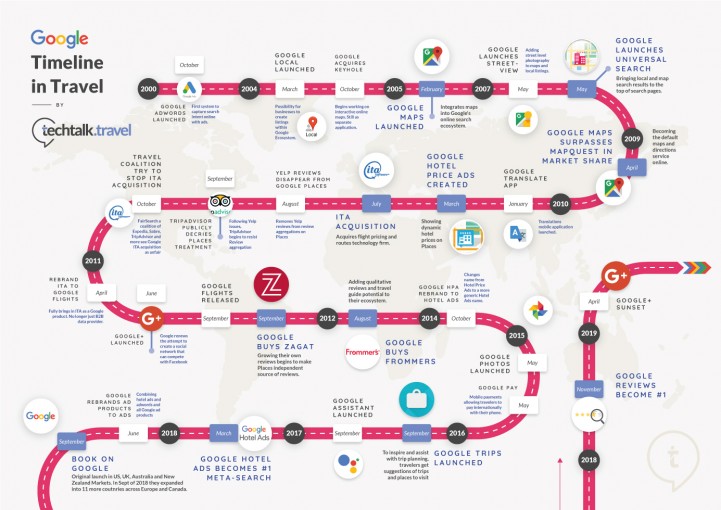

Metasearch has also become a massively powerful lever for hotels. The pay-per-click pricing is much more affordable than the double-digit commissions from most OTAs. Plus, the PPC model means that it can be ramped up and down as needed, providing a flexible ally to a direct booking strategy. As Mark Fancourt of TRAVHOTECH highlights in his comprehensive editorial on Google’s influence in the travel industry, hotels will never have the scale to personalize the way these platform partners can:

It would be hard to imagine a company better positioned to lead the charge toward personalization. The volume of personal data in the current warehouse, growing exponentially, sets the company in good stead to personalize the travel search experience. Google can leverage information from travel with broader demographic and personal information from their user base.

Intermediaries offer a predictable and efficient source of demand -- especially for unaffiliated independents, which Expedia says are being “booked more frequently than they did in the past” because chain hotels appear lower in Expedia’s search results than they did in the past.” Intermediaries do a lot of heavy lifting for hotels, who can then focus on delivering a knockout guest experience -- and engage guests with a loyalty-driven mindset that turns transient guests into fervent brand advocates.

Download both the Google article and the infographic here.

Transactional or relational?

What this all comes down to is what kind of hotel you want to be: transactional or relational. A transactional view of a hotel booking looks only at the customer acquisition cost of a single booking. A relational view of a hotel booking considers the cost of a single booking in the context of the guest’s lifetime value.

It’s the transactional view that sees OTAs as unwelcome leeches on hotel profits. The relational view accepts intermediaries, and puts the onus on the hotel to turn guest acquired through third-parties into repeat guests.

With the focus on building relationships, the long-term value of a guest becomes more important than the profitability of any one booking. It’s not only about optimizing how you acquire customers -- but also how you keep them.

Hotels must refocus on making the guests in-house stay the best it can be and convert guests from all channels into loyal, fervent brand advocates. The more times a guest stays within the same network, the lower the overall acquisition costs.

Certain platforms may deliver more loyal guests, and legitimize the higher customer acquisition costs because your hotel can pull these guests into your loyalty marketing campaigns. Other platforms may be purely transient but with more reliable demand, which put heads in beds but may not foster long-term guest relationships. Ultimately, it's up to your own hotel’s front desk to capture the relevant details that form the foundation for a long-term guest relationship.

The mix matters most

Each channel has its singular characteristics. Hotels must be keenly aware of these qualities. Each channel can then be harnessed effectively. The ultimate goal is a channel mix that provides the strongest demand at the highest rates, most consistently and at the lowest distribution cost.

“There is nothing wrong with third-party business, but operators should take a hard look at demand in their marketplace. For some hotels, optimal demand mix from OTAs is 5 percent. For others, it’s 25 percent.”

-Cindy Estis Green, CEO Kalibri Labs

The right channel mix for your property will change over time, depending on things like local market demand, how your competitive set prices its rooms, and the naturally shifting blend of bookings for your hotel. Channel mix is definitely not an auto-pilot kind of process! Tweak your channel mix according to the value and demand of each channel individually.

Don’t be afraid to embrace the strategy that works best for your hotel -- direct booking campaigns be damned. Pursue the most profitable bookings and reduce reliance on high-cost channels. And yes, the direct channel can sometimes be the highest cost channel! What’s at stake here is more about ownership of the guest relationship, rather than cost. If you can convert a transient OTA guest into a loyal customer, the lifetime value far outweighs the 20% commission paid on that first booking.

Regardless of what mainstream marketing campaigns suggest, direct booking isn't always best! By taking a relational perspective, the source of your guest matters less than how you approach guest interactions. Well-trained staff recognize that each guest is different, and management must empower staff to move beyond the single booking and nurture a long-term relationship with each guest. It’s all about the relationship rather than channel.

Also find these complementary content pieces about 'OTAs - The Uncomfortable Truth':

- INFOGRAPHIC l OTAs - The Uncomfortable Truth - Cost Calculator

- VIDEO l OTAs - The Uncomfortable Truth

- PODCAST l Expert Panel with Charlie Osmond (Triptease), Tobias Köhler (Ruby Hotels & HSMA Deutschland e.V.) and David Turnbull (former Snapshot and today denizen)

Find all techtalk.travel editorials here.

Free download

Free download

![V03: The History of Hotel & Travel Technology | [Updated] Infographic](https://www.techtalk.travel/storage/app/uploads/public/63f/e6f/ec8/63fe6fec80447817849943.jpg)

Create an account to access the content.

Get access to Articles, Video's, Podcasts, Think Tanks, Infographics and more.

Click “Sign In” to accept our

Terms of Service Privacy Policy